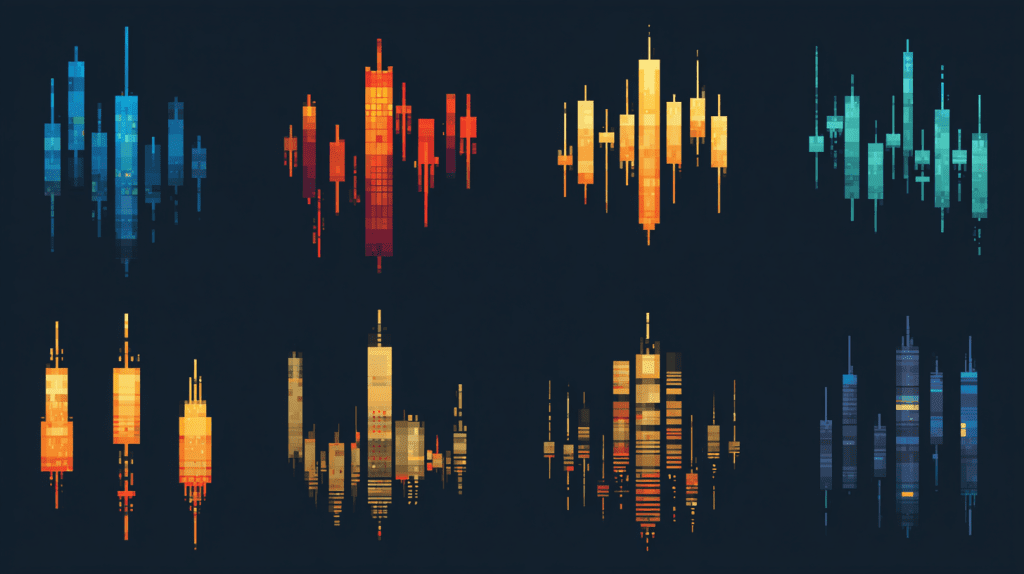

Technical analysis forms the foundation of modern trading strategies, providing traders with visual tools to interpret market psychology and price action. Among the various analytical methods available, candlestick patterns have emerged as one of the most reliable and widely adopted techniques for predicting future price movements. These visual formations offer insights into the ongoing battle between buyers and sellers, revealing potential reversals, continuations, and market indecision.

Whether you’re trading stocks, forex, cryptocurrencies, or commodities, mastering candlestick pattern recognition provides a competitive edge in identifying profitable opportunities. This comprehensive guide explores the essential candle stick patterns every trader should know, from their historical origins to practical applications in today’s markets.

What Are Candlestick Patterns

Candlestick patterns represent specific formations created by one or more candlesticks on a price chart, each telling a story about market sentiment during a particular trading period. Unlike simple line charts that only show closing prices, candlestick chart patterns display opening, closing, high, and low prices within a single visual element. This rich information density allows traders to quickly assess whether bulls or bears controlled a trading session.

A chart pattern forms when candlesticks arrange themselves in recognizable configurations that historically precede specific price movements. Traders across all markets—from traditional stock market patterns to cryptocurrency exchanges—rely on these formations to make informed decisions. The visual nature of candlesticks makes pattern recognition more intuitive than interpreting raw numerical data.

History and Origin of Candlestick Charts

The story of Japanese candlestick patterns begins in 18th-century Japan, where rice trader Munehisa Homma developed the technique to track rice prices in Osaka. Homma recognized that emotion and psychology influenced markets as much as supply and demand fundamentals. His methods eventually evolved into the candlestick charting system used globally today.

Western traders discovered these techniques in the 1980s when Steve Nison introduced them through his seminal work on Japanese candlestick charting. The adoption was swift—traders immediately recognized how candlesticks conveyed more information at a glance than traditional Western charting methods. This centuries-old wisdom continues to prove relevant in modern electronic markets, demonstrating timeless principles of market psychology.

Why Traders Use Candlestick Patterns

Traders gravitate toward candlestick patterns for several compelling reasons. First, they provide immediate visual feedback about market sentiment without requiring complex calculations. Second, these stock pattern formations often appear at critical turning points, giving traders advance warning of potential reversals or continuations.

Additionally, pattern trading using candlesticks works across all timeframes—from one-minute scalping charts to monthly position trading views. This versatility makes them valuable for day traders, swing traders, and long-term investors alike. The universal adoption across markets also creates self-fulfilling prophecies, as millions of traders worldwide respond similarly to the same formations.

How Candlestick Patterns Work

Understanding the mechanics behind candlestick formations reveals why certain patterns consistently predict market behavior. Each candlestick captures a complete narrative of price action during its timeframe, documenting the opening transaction, the range of prices traded, and where the period ultimately closed. When multiple candlesticks form specific sequences, they illustrate shifting momentum and potential exhaustion of trends.

The predictive power of technical analysis patterns stems from their reflection of collective market psychology. Large institutional orders, retail panic selling, short covering, and profit-taking all leave distinctive footprints in candlestick formations.

Anatomy of a Candlestick (Body, Wick, Color)

Every candlestick consists of three essential components that convey different information. The body—the rectangular portion—shows the range between opening and closing prices. A thick body indicates significant price movement during the period, suggesting strong conviction from either buyers or sellers.

The wicks, also called shadows or tails, extend above and below the body, marking the high and low prices reached during the timeframe. Long wicks indicate price rejection—buyers or sellers temporarily pushed prices in one direction before the opposing force drove them back. Short wicks suggest acceptance of the price range without significant challenges.

Color coding provides instant sentiment feedback. Green or white candlesticks indicate bullish periods where closing prices exceeded opening prices. Red or black candlesticks signal bearish sessions where prices closed lower than they opened. Color immediately communicates whether bulls or bears won that particular battle.

Bullish vs Bearish Candlesticks

Individual candlesticks begin forming recognizable bullish candlestick patterns or bearish candlestick patterns based on their characteristics. Bullish candlesticks typically feature larger bodies with small upper wicks and longer lower wicks, suggesting buyers absorbed selling pressure and drove prices higher. The longer the body relative to the wicks, the more convincingly buyers controlled the session.

Bearish candlesticks display opposite characteristics—larger bodies with minimal lower wicks and extended upper wicks. This formation shows sellers rejected higher prices and forced closings near session lows. The trading pattern embedded in individual candlesticks multiplies in significance when they combine into recognized multi-candle formations.

Types of Candlestick Patterns

Technical analysts categorize stock market chart patterns into three primary groups based on how many candlesticks comprise them. This classification helps traders systematically learn and identify formations during live market conditions.

Single Candlestick Patterns

Single candlestick patterns deliver complete information within one trading period, making them the fastest signals to identify and act upon. These patterns include hammers, shooting stars, doji candlestick formations, and spinning tops. While individual candles can provide valuable insights, experienced traders typically wait for subsequent price action to confirm the signal before committing capital.

The strength of single-candle patterns depends heavily on context—where they appear relative to recent price action. A hammer candlestick appearing after an extended downtrend carries far more significance than one occurring mid-trend.

Dual Candlestick Patterns

Two-candle formations compare consecutive periods to reveal shifting momentum. Popular dual patterns include bullish and bearish engulfing formations, tweezer tops and bottoms, and piercing patterns. The engulfing pattern specifically demonstrates dramatic sentiment shifts as one session’s entire range gets consumed by the following session’s opposite movement.

Dual patterns generally provide more reliable signals than single candlesticks because they demonstrate sustained momentum over multiple periods.

Multiple Candlestick Patterns

Complex formations spanning three or more candlesticks tell more detailed stories about evolving market psychology. These technical analysis candlesticks include morning star and evening star formations, three white soldiers, three black crows, and various triangle patterns. While requiring more patience to develop, multiple-candle patterns typically offer higher probability setups.

The additional time required for these patterns to complete also means more traders notice them simultaneously, often creating stronger moves when the pattern confirms.

Most Popular Bullish Candlestick Patterns

Bullish formations signal potential trend reversals from down to up or strong continuation within existing uptrends. Recognizing these candlestick reversal patterns at support levels or after oversold conditions can identify optimal entry points for long positions.

Hammer and Inverted Hammer

The hammer candlestick appears after downtrends and features a small body near the top of the range with a long lower wick at least twice the body length. This formation demonstrates that despite significant selling pressure pushing prices lower during the session, buyers ultimately regained control and drove prices back up near the opening. The long lower shadow represents rejected lows—a bullish signal suggesting selling exhaustion.

The inverted hammer displays similar psychology with reversed geometry—a small body near the bottom with a long upper wick. If the following session opens with a gap up or strong buying, it confirms that the attempted breakout will succeed, validating the pattern.

Both hammer variants work most effectively when appearing after clear downtrends at identifiable support levels. Volume analysis enhances reliability—higher volume on the hammer session suggests stronger conviction from buyers stepping in to reverse the decline.

Morning Star

The morning star candlestick represents one of the most powerful bullish reversal formations in technical analysis. This three-candle pattern begins with a long bearish candle confirming the existing downtrend. The second candle gaps down but forms a small body, indicating indecision as selling pressure diminishes. The third candle delivers confirmation—a long bullish candle that closes well into the first candle’s body, demonstrating buyers have seized control.

The morning star’s predictive power stems from its clear documentation of sentiment shift. The first candle shows bears in command, the middle candle reveals their exhaustion, and the final candle proves bulls have taken over. Traders often enter positions during or immediately after the third candle forms, placing stops below the pattern’s low.

Bullish Engulfing

The bullish engulfing pattern consists of two candles where a small bearish candle is completely engulfed by the following larger bullish candle. The second candle opens below the prior close and proceeds to rally strongly, closing above the previous opening price. This complete consumption of the prior session’s range demonstrates overwhelming buying pressure.

Size matters with engulfing patterns—the larger the engulfing candle relative to the engulfed candle, the more powerful the signal. Volume confirmation adds credibility; significantly higher volume on the engulfing candle suggests institutional participation rather than temporary retail enthusiasm.

Most Popular Bearish Candlestick Patterns

Bearish formations warn of potential trend reversals from up to down or continuation of existing downtrends. Identifying these patterns near resistance levels or after overbought conditions helps traders protect profits, exit long positions, or establish short positions.

Shooting Star

The shooting star appears after uptrends and features a small body near the bottom of the range with a long upper wick extending at least twice the body height. This candlestick continuation patterns or reversal signal demonstrates that despite bulls pushing prices significantly higher during the session, bears ultimately regained control and drove prices back down near the opening.

The long upper shadow represents price rejection—a bearish signal suggesting buying exhaustion at those elevated levels. Confirmation typically comes from the following session opening with a gap down or immediate selling pressure.

Evening Star

The evening star candlestick mirrors the morning star but signals bearish reversals. This three-candle formation begins with a long bullish candle continuing the uptrend. The second candle gaps up but forms a small body, revealing indecision as buying pressure wanes. The third candle confirms the reversal—a long bearish candle that closes well into the first candle’s body.

This pattern’s power lies in its clear narrative arc: initial bullish continuation, sudden uncertainty, and finally decisive bearish control. Evening stars perform best at major resistance zones or following parabolic advances that stretched too far too fast.

Bearish Engulfing

The bearish engulfing pattern features a small bullish candle completely consumed by the following larger bearish candle. The second candle opens above the prior close, then proceeds to decline strongly, closing below the previous opening price. This complete reversal within one session signals that sellers have seized control from buyers.

Context determines reliability. Bearish engulfing patterns at resistance levels or after extended rallies carry more weight than those appearing mid-trend. Volume confirmation proves particularly valuable—significantly elevated volume on the engulfing bearish candle suggests institutional distribution.

Neutral and Continuation Candlestick Patterns

Not all candlestick trading strategies focus on reversals. Some patterns indicate indecision or suggest the current trend will continue after brief consolidation.

Doji Candlestick

The doji candlestick forms when opening and closing prices occur at nearly identical levels, creating a cross or plus sign appearance with minimal or no body. This formation represents perfect equilibrium between buyers and sellers—neither side gained advantage during the session. While the doji appears neutral in isolation, its implications depend entirely on surrounding context.

In uptrends, dojis warn of potential exhaustion as bulls lose momentum. In downtrends, they suggest selling pressure may be waning. Different doji variants include the long-legged doji, gravestone doji, and dragonfly doji, each with subtle psychological differences.

Spinning Top

Spinning tops feature small bodies with upper and lower wicks of roughly equal length, indicating indecision but with slightly more defined directional bias than dojis. The small body shows minimal difference between opening and closing prices, while equal wicks demonstrate both buyers and sellers tested their boundaries without establishing control.

Traders often observe spinning top clusters during consolidation phases before significant breakouts. Multiple spinning tops in succession indicate extended indecision as the market builds energy for the next major move.

Three White Soldiers and Three Black Crows

The three white soldiers pattern consists of three consecutive long bullish candles with progressively higher closes, each opening within the previous candle’s body. This formation demonstrates sustained, methodical buying pressure over multiple sessions.

Conversely, three black crows display three consecutive long bearish candles with progressively lower closes, each opening within the prior candle’s body. This methodical decline over multiple sessions indicates persistent selling pressure and bearish conviction.

How to Read Candlestick Patterns Effectively

Recognizing patterns represents just the first step. Effective implementation requires understanding context, confirmation, and integration with broader analysis.

Timeframes and Market Context

The same pattern carries different implications across timeframes. A bullish engulfing on a daily chart suggests a significant reversal potentially lasting weeks, while the identical pattern on a five-minute chart might only produce a brief intraday bounce. Traders must align pattern interpretation with their trading timeframe and objectives.

Market context matters enormously. Patterns appearing at major support or resistance levels, trend lines, or Fibonacci retracements carry more weight than those forming in the middle of ranges. The broader trend provides crucial context—trading reversal patterns against strong trends proves challenging.

Combining Candlesticks With Indicators

Technical analysis patterns work best when confirmed by additional indicators. Volume analysis proves particularly valuable—patterns accompanied by significantly elevated volume carry more weight than those on light volume.

Moving averages provide trend context. Bullish patterns appearing while prices remain above key moving averages carry more credibility than those occurring well below these benchmarks. Oscillators like RSI and MACD identify overbought or oversold conditions that enhance pattern reliability.

Pros and Cons of Using Candlestick Patterns

Like all analytical tools, candlestick patterns offer distinct advantages while carrying inherent limitations.

Benefits for Technical Analysis

Candlestick patterns provide immediate visual feedback about market psychology without requiring complex calculations or proprietary software. Any trader with a basic charting platform can identify and utilize these formations. This accessibility democratizes technical analysis, giving retail traders tools similar to institutional professionals.

The visual nature accelerates pattern recognition with experience. Veteran traders spot formations instantly that beginners might miss entirely. Candlestick analysis works across all markets and timeframes, providing consistent methodology regardless of whether trading stocks, forex, commodities, or cryptocurrencies.

Limitations and Common Mistakes

Despite their popularity, candlestick patterns aren’t infallible. Even the most reliable formations fail frequently enough to require strict risk management. Traders who blindly follow patterns without confirmation or stops often suffer significant losses when market conditions override technical signals.

Subjectivity creates interpretation challenges. What one trader identifies as a perfect hammer, another might dismiss as merely a bullish candle with a slightly longer wick. Pattern proliferation creates analysis paralysis—traders sometimes see patterns everywhere, leading to overtrading and reduced selectivity.

Candlestick Patterns vs Other Charting Techniques

Candlestick charts compete with alternative visualization methods, each offering distinct advantages.

Line Charts

Line charts plot only closing prices, creating clean, uncluttered visualizations that clearly display overall trends without the noise of intraday volatility. However, line charts sacrifice the rich information embedded in candlesticks—opening prices, intraday ranges, and the relationship between these data points.

For traders focused exclusively on closing prices and long-term trends, line charts suffice. But most active traders prefer candlesticks’ additional information, viewing the extra visual complexity as worthwhile for the enhanced insight.

Bar Charts

Bar charts display the same data as candlesticks using vertical lines with horizontal ticks indicating opening and closing prices. While containing identical information, bar charts lack the immediate visual impact of candlesticks. The color-coded bodies of candlesticks instantly communicate whether a period was bullish or bearish, while bars require closer inspection.

This visualization difference matters significantly when scanning multiple charts or timeframes. Candlesticks’ superior visual communication accelerates analysis, allowing traders to process information more quickly.

Conclusion: Do Candlestick Patterns Improve Trading Success?

Candlestick patterns represent powerful tools within a trader’s analytical arsenal, but they function best as components of comprehensive strategies rather than standalone systems. The centuries-old wisdom embedded in how to read candlestick charts continues proving relevant because it captures timeless aspects of market psychology—fear, greed, indecision, and conviction all manifest in recognizable formations.

However, patterns alone cannot guarantee success. Effective traders combine candlestick analysis with robust risk management, position sizing discipline, fundamental awareness, and additional technical indicators. They recognize that patterns provide probabilistic edges rather than certainties, accepting that even the best setups fail occasionally.

The true value of mastering stock market chart patterns lies not in finding perfect predictions, but in developing frameworks for making consistently rational decisions under uncertainty. Candlesticks help traders visualize market dynamics, identify high-probability opportunities, and maintain discipline by providing objective entry and exit criteria. When integrated thoughtfully into broader trading plans, these time-tested formations enhance decision-making and improve trading outcomes across all markets and timeframes.