A Turning Point in Economic History

For decades, globalization defined the trajectory of world trade. Supply chains stretched across continents, manufacturing migrated to lowest-cost locations, and international commerce grew faster than global GDP. This interconnected system delivered lower consumer prices, corporate profit growth, and lifted hundreds of millions out of poverty. However, recent years have witnessed a dramatic shift as localization, reshoring, and regionalization challenge the globalization paradigm that seemed inevitable just a decade ago.

The COVID-19 pandemic exposed vulnerabilities in global supply chains, geopolitical tensions fractured international cooperation, and rising nationalism fueled protectionist policies. Climate concerns added pressure to reduce transportation emissions from long-distance shipping. Technological advances in automation made domestic manufacturing more cost-competitive. These converging forces have triggered fundamental questions about the future structure of global trade.

Will the world continue down the globalization path toward ever-greater integration, or are we witnessing a permanent shift toward localization and regional self-sufficiency? The answer profoundly affects economic growth, employment patterns, consumer prices, corporate strategies, and geopolitical power dynamics. This article explores both trends, examining the forces driving each direction and the likely future balance between localization and globalization in the emerging world order.

The Globalization Era: Understanding What Built the Current System

How We Got Here

Modern globalization accelerated dramatically after the Cold War ended in 1991, removing ideological barriers to international commerce. The World Trade Organization’s formation in 1995 established rules-based international trade frameworks. China’s WTO accession in 2001 integrated the world’s most populous nation into the global trading system. Container shipping, air freight, and digital communication technologies made coordinating complex international operations practical and affordable.

This era created unprecedented specialization. Companies disaggregated production processes, locating each step where it could be performed most efficiently. Electronics might be designed in California, with components manufactured in Taiwan, South Korea, and Japan, assembled in China, and sold globally. This specialization delivered efficiency gains that reduced costs and expanded consumer choice.

The Benefits That Drove Adoption

Globalization generated substantial benefits that explain its rapid adoption. Consumers in developed nations enjoyed dramatically lower prices for goods from electronics to clothing, effectively increasing purchasing power and living standards. Developing nations experienced rapid industrialization, job creation, and poverty reduction as manufacturing investment flowed to countries offering competitive labor costs.

Corporations achieved higher profit margins through global cost optimization, accessing the best talent worldwide, and serving larger markets that justified massive research and development investments. Global competition spurred innovation as companies worldwide competed for market share. The system seemed to offer benefits for all participants, creating powerful constituencies supporting continued integration.

Forces Driving Localization and Reshoring

Supply Chain Vulnerabilities Exposed

The pandemic revealed the fragility of highly optimized global supply chains. When Chinese factories shut down, products ranging from electronics to pharmaceuticals became unavailable globally. Just-in-time inventory systems that minimized warehousing costs left no buffers for disruption. Single-source dependencies meant that problems in one factory could halt production worldwide.

These vulnerabilities extended beyond pandemics. Natural disasters, political instability, labor disputes, or transportation disruptions in one region rippled globally. The Suez Canal blockage in 2021 demonstrated how single chokepoints could paralyze international trade. Companies began questioning whether efficiency maximization worth the fragility it created, reconsidering the balance between cost optimization and resilience.

Geopolitical Tensions and Economic Security

Rising tensions between major powers, particularly the United States and China, have fragmented the global trading system. Both nations increasingly view economic interdependence as strategic vulnerability rather than mutual benefit. The United States restricts Chinese access to advanced semiconductors and other technologies. China pursues self-sufficiency in critical sectors through industrial policy. This “strategic decoupling” reverses decades of integration.

National security concerns now dominate trade policy discussions. Countries identify critical industries—semiconductors, pharmaceuticals, rare earth minerals, advanced manufacturing—where foreign dependence creates unacceptable risks. Government subsidies encourage domestic production of strategic goods previously sourced internationally. This trend reflects the prioritization of security over economic efficiency, marking a fundamental philosophical shift in trade policy.

Technological Enablers of Localization

Technological advances make localization more economically viable than in previous decades. Industrial automation, artificial intelligence, and robotics reduce labor cost advantages that historically drove offshoring. Advanced manufacturing techniques like 3D printing enable cost-effective small-batch production, eliminating economies of scale that favored massive centralized factories.

These technologies allow reshored production to compete on cost while offering advantages in speed to market, customization capabilities, and intellectual property protection. The labor cost differential between developed and developing nations matters less when robots perform most manufacturing tasks. This technological shift removes a primary barrier to localization.

The Case for Continued Globalization

Economic Efficiency and Comparative Advantage

Despite localization pressures, powerful economic arguments support continued globalization. The principle of comparative advantage—that countries should specialize in what they do most efficiently—remains economically sound. Complete self-sufficiency requires nations to produce goods inefficiently, reducing overall economic output and living standards.

Certain resources exist concentrated in specific geographies. Rare earth minerals, specific agricultural products, and energy resources cannot be economically produced everywhere. International trade remains necessary for accessing these inputs. Attempting complete self-sufficiency in all goods would dramatically increase costs and reduce quality for consumers.

Innovation Through Global Collaboration

Scientific and technological progress increasingly depends on international collaboration. Research teams span continents, combining expertise that doesn’t exist within any single nation. Global supply chains allow specialization where different countries focus on elements they perform best, driving innovation through focused expertise rather than forcing all nations to develop all capabilities.

The semiconductor industry exemplifies this collaborative model. Chip design occurs primarily in the United States and Europe, specialized equipment comes from the Netherlands and Japan, advanced manufacturing happens in Taiwan and South Korea, and assembly occurs in various Southeast Asian countries. Each step requires decades of accumulated expertise and massive capital investment. Fragmenting this integrated system would set back technological progress significantly while raising costs dramatically.

Regional Trade Blocs: The Middle Ground

The Rise of Regional Integration

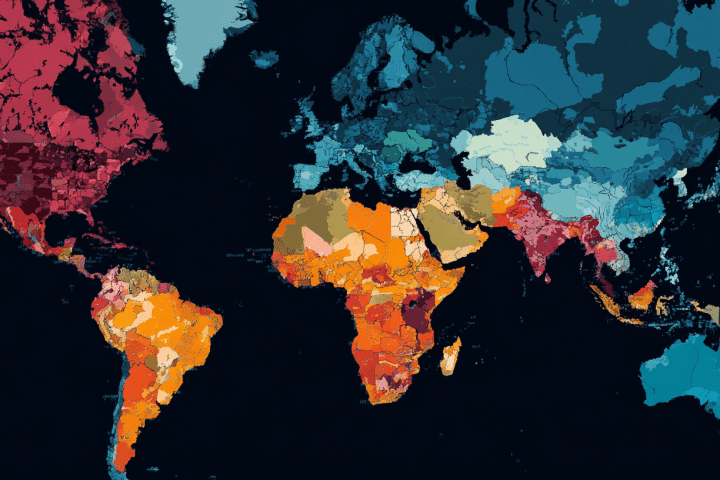

Rather than pure globalization or complete localization, regional trade blocs represent a compromise gaining momentum. The European Union, United States-Mexico-Canada Agreement (USMCA), Regional Comprehensive Economic Partnership (RCEP) in Asia, and African Continental Free Trade Area create large trading zones with internal integration but external barriers.

This regionalization offers benefits of both approaches:

- Supply chain resilience: Regional sourcing reduces transportation distances and geopolitical vulnerabilities compared to global chains

- Economic efficiency: Large regional markets still enable specialization and economies of scale beyond what pure localization allows

- Political feasibility: Regional agreements prove easier to negotiate than global frameworks given shared interests and values among neighboring nations

- Security considerations: Strategic goods stay within allied nations while non-critical items trade globally

Regional blocs may represent the future equilibrium—deep integration within geopolitical spheres combined with limited trade between rival blocs.

Competing Regional Systems

The emerging regional structure creates competing economic systems. A U.S.-led bloc includes traditional Western allies in Europe, Japan, South Korea, and Australia. A China-centered bloc encompasses much of Asia and extends through Belt and Road Initiative partnerships. Other regions like India position themselves between these systems, pursuing strategic autonomy while engaging both spheres.

This fragmented structure reduces global efficiency compared to unified systems but increases resilience by avoiding single points of failure. It also creates geopolitical competition as blocs vie for uncommitted nations’ alignment, potentially delivering better terms for countries that skillfully navigate between competing systems.

The Five Key Factors That Will Determine the Future Balance

Multiple variables will determine whether localization or globalization dominates future trade patterns. Understanding these factors helps predict likely outcomes and prepare accordingly:

- Geopolitical Stability vs. Conflict Escalation: If major powers manage tensions through diplomacy and maintain peaceful competition, economic logic favoring globalization reasserts itself; however, if conflicts escalate through trade wars, sanctions, or military confrontation, localization accelerates as nations prioritize security over efficiency and economic interdependence decreases

- Technology Cost Curves: The relative cost of automation versus human labor determines manufacturing location economics; if automation costs decline faster than developing nation wages rise, reshoring to developed nations becomes economically rational; conversely, if labor cost advantages persist despite automation, global supply chains remain attractive

- Climate Policy Implementation: Aggressive carbon pricing or border adjustment mechanisms that penalize long-distance shipping favor regional production, while continued climate policy delays maintain current globalization patterns; the weight given to reducing transportation emissions versus other considerations significantly impacts trade geography

- Consumer Willingness to Pay: If consumers demand locally-produced goods and accept higher prices, companies respond with localized production; however, if price sensitivity dominates purchasing decisions, pressure to minimize costs through global sourcing continues; this consumer behavior varies across product categories and income levels

- Government Policy Direction: Trade policy, industrial subsidies, tariffs, and investment restrictions directly shape corporate location decisions; coordinated government support for localization through subsidies and procurement preferences accelerates the trend, while free trade commitments and reduction of barriers support continued globalization

These factors interact in complex ways, and their relative weights vary across industries, countries, and time periods, making simple predictions impossible.

Industry-Specific Outcomes: One Size Doesn’t Fit All

Industries Moving Toward Localization

Certain sectors show clear localization trends. Pharmaceuticals and medical supplies, deemed critical for public health after pandemic shortages, face government pressure and incentives for domestic production. Advanced semiconductors, viewed as strategic technologies, see massive government subsidies encouraging domestic manufacturing despite astronomical costs.

Defense-related industries increasingly face requirements for domestic production to ensure supply security during conflicts. Food production experiences localization pressure from both security concerns and sustainability considerations around transportation emissions. These strategic sectors will likely see continued localization regardless of economic efficiency arguments.

Industries Remaining Global

Other sectors will remain fundamentally global. Extractive industries—mining, oil and gas—produce where resources exist regardless of policy preferences. Highly specialized manufacturing with massive economies of scale, like aircraft production or advanced pharmaceutical research, concentrates in a few global centers of excellence.

Consumer electronics, despite some production shifts, will likely remain globally integrated given the complexity, specialization, and capital requirements involved. Fashion and apparel may see some nearshoring to developed markets for speed and customization, but cost-sensitive segments will maintain production in low-wage countries.

Implications for Different Stakeholders

For Businesses and Corporations

Companies face difficult strategic decisions about supply chain configuration. Purely optimizing for cost may prove shortsighted if disruptions or policy changes force expensive reorganization. However, prematurely localizing when competitors maintain efficient global chains risks competitive disadvantage.

Smart corporate strategy involves scenario planning and flexibility. Design supply chains capable of adaptation as conditions evolve. Maintain some redundancy and multiple sourcing options even if slightly more expensive. Build relationships across regions rather than concentrating in single geographies. Consider regional strategies where products for European markets are manufactured in Europe, Asian products in Asia, and American products in the Americas.

For Workers and Labor Markets

Localization benefits workers in developed nations through manufacturing job creation previously lost to offshoring. However, automation often accompanies reshoring, limiting job creation. The returning jobs differ from those that left—requiring higher skills, paying better wages, but employing fewer workers.

Developing nation workers face challenges if manufacturing relocates away. Countries that built economies around export manufacturing must diversify and move up value chains. This transition proves difficult and potentially creates political instability if jobs disappear faster than alternatives emerge.

For Consumers

Localization likely means higher prices for goods as production shifts from lowest-cost locations to domestic or regional manufacturing. The magnitude depends on product categories—highly automated production sees minimal cost increases, while labor-intensive goods become substantially more expensive.

However, consumers may benefit from improved quality, faster delivery, better customization, and reduced environmental impact from shorter supply chains. Some consumers willingly pay premiums for locally-produced goods supporting domestic employment and reducing environmental footprint. This creates market segmentation where premium segments localize while price-sensitive segments remain global.

The Most Likely Future: Hybrid Systems

Neither Extreme Prevails

Rather than complete localization or continued pure globalization, the most probable outcome involves hybrid systems balancing multiple considerations. Critical and strategic goods will increasingly produce domestically or within regional blocs regardless of cost. Non-strategic consumer goods will maintain global supply chains optimized for efficiency.

This bifurcation creates a two-tier system. Products involving security considerations, high geopolitical risk, or strong localization preferences operate under different rules than commodity goods where cost determines sourcing. Companies navigate this complexity by developing sophisticated supply chain strategies tailored to specific products and markets.

Adaptive and Resilient Structures

Future supply chains will prioritize resilience alongside efficiency. Companies maintain multiple sourcing options, hold larger inventories of critical components, and design products to accommodate alternative inputs. This redundancy costs more than lean optimization but provides insurance against disruptions.

Technology enables this adaptation. Advanced analytics identify vulnerabilities, simulation models test resilience under various scenarios, and digital twins of supply chains allow experimentation with alternative configurations. These tools help companies find optimal balances between efficiency and resilience for their specific circumstances.

Conclusion: Navigating the Transformation

The future of global trade involves neither pure localization nor unrestricted globalization but rather a complex, evolving balance between these forces. The precise equilibrium will vary across industries, products, regions, and time periods based on geopolitical developments, technological changes, policy decisions, and economic conditions.

For nations, businesses, and individuals, success requires understanding these dynamics and maintaining flexibility to adapt as circumstances evolve. The globalization era’s certainties have ended, replaced by a more complex environment requiring sophisticated navigation. Those who rigidly commit to either extreme—assuming either complete localization or continued pure globalization—risk being caught wrong-footed as the hybrid reality unfolds.

The transformation of global trade represents both challenge and opportunity. While uncertainty creates difficulties, it also enables competitive advantage for those who adapt most effectively. The coming decades will witness the construction of new trading systems balancing efficiency with resilience, economic optimization with security concerns, and global integration with regional autonomy. Understanding these competing forces and their likely trajectory provides the foundation for thriving in this transforming landscape.