The global economic landscape is undergoing dramatic transformation as nations increasingly embrace protectionist trade policies through tariffs, reshaping international commerce patterns established over decades of globalization. As we approach 2026, the age of tariffs has created distinct winners and losers across countries, industries, and economic classes. Understanding these shifting dynamics has become essential for investors, business leaders, policymakers, and anyone seeking to navigate an increasingly fragmented global economy where trade barriers replace the free-flow ideals that dominated the post-Cold War era.

The Rise of Neo-Protectionism

From Globalization to Trade Wars

The globalization era spanning the 1990s through 2010s promised prosperity through open markets, integrated supply chains, and comparative advantage exploitation. Manufacturing migrated to low-cost regions, multinational corporations optimized operations globally, and consumers enjoyed unprecedented product variety at decreasing prices. However, this system created significant dislocations including industrial job losses in developed nations, wage stagnation for workers, and geopolitical dependencies on rival nations for critical goods.

The pendulum has swung decisively toward protectionism as countries prioritize domestic manufacturing, national security, and economic sovereignty over efficiency maximization. Tariffs—taxes on imported goods—have become primary policy tools for governments seeking to reshape trade relationships, protect strategic industries, and reshore manufacturing capabilities. This shift accelerates through 2025 and into 2026, fundamentally altering global commerce patterns and creating new economic realities.

Motivations Behind Tariff Escalation

Multiple factors drive the tariff resurgence beyond simple economic nationalism. National security concerns about dependence on geopolitical rivals for semiconductors, pharmaceuticals, rare earth minerals, and other critical inputs motivate protective barriers. Environmental and labor standards create justification for tariffs on goods produced under lax regulations, with border carbon adjustments and social tariffs gaining prominence. Industrial policy ambitions to develop domestic capabilities in emerging technologies like artificial intelligence, quantum computing, and clean energy technologies prompt import restrictions protecting nascent industries.

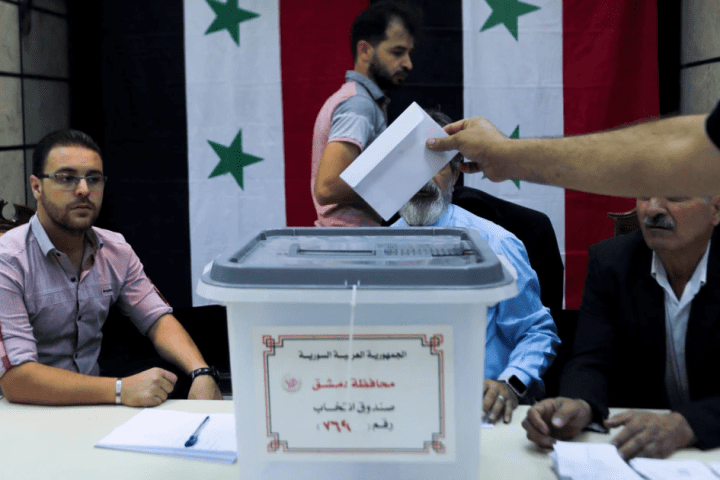

Political considerations significantly influence tariff policies. Protecting manufacturing jobs in politically important regions delivers electoral benefits even when broader economic impacts prove negative. Tariffs generate government revenue while signaling strength to domestic audiences and foreign adversaries. These political incentives ensure tariff policies persist regardless of economic efficiency arguments from free-trade advocates.

Regional Winners and Losers

United States: Mixed Outcomes

American tariff policies aim to reshore manufacturing, reduce trade deficits, and decrease dependence on Chinese production. Certain industries and regions benefit substantially from these protections. Steel and aluminum producers enjoy higher prices and increased domestic market share. Manufacturing employment in protected sectors grows as companies relocate production to avoid tariffs. Regional economies in the Rust Belt and manufacturing-heavy states experience modest revivals as factory employment increases.

However, significant negative consequences offset these gains. Consumer prices rise across categories as tariffs increase costs for imported goods and domestic products facing reduced competition. Export-oriented industries suffer from retaliatory tariffs imposed by trading partners, with agriculture particularly hard-hit as foreign markets close to American products. Supply chain disruptions and increased input costs reduce competitiveness for manufacturers using imported components, undermining the very industries tariffs intend to protect.

China: Adaptation and Reorientation

Chinese economic strategy pivots substantially in response to Western tariffs and decoupling efforts. The Belt and Road Initiative accelerates as China develops alternative markets in Asia, Africa, and Latin America less influenced by Western pressure. Domestic consumption receives greater policy emphasis reducing export dependence. Technological self-sufficiency drives massive investments in semiconductors, software, and advanced manufacturing despite efficiency penalties from reinventing capabilities available from foreign suppliers.

China’s massive domestic market and manufacturing infrastructure provide resilience against tariff impacts. While export growth to Western markets slows, China maintains advantages in production capacity, supply chain integration, and cost competitiveness for many goods. Strategic sectors receive state support ensuring continued advancement despite Western restrictions, though innovation may slow without access to cutting-edge foreign technology and talent.

European Union: Balancing Act Challenges

Europe navigates complex positioning between American and Chinese spheres while protecting its own economic interests. The EU implements carbon border adjustments taxing imports based on embedded emissions, effectively protecting European industries from competitors in countries with weaker environmental standards. Industrial policy initiatives support strategic sectors including semiconductors, batteries, and green technologies through subsidies and procurement preferences.

However, Europe’s export-dependent economies face significant headwinds from global tariff escalation. German automotive manufacturers suffer from both tariffs on exports and competition from protected domestic producers in key markets. The EU’s commitment to rules-based trade and multilateral institutions limits aggressive retaliatory measures, potentially disadvantaging European companies versus competitors from nations willing to use all available policy tools.

Industry-Specific Impacts

Manufacturing: Reshoring vs. Efficiency Trade-offs

Manufacturing represents the primary battleground in tariff conflicts as nations compete to maintain or develop production capabilities. Protected industries experience immediate benefits through reduced foreign competition enabling price increases and capacity expansion. Companies previously offshoring production increasingly reshore operations to avoid tariffs and reduce supply chain risks, creating domestic employment and capital investment.

The benefits of manufacturing protection come with substantial costs:

- Higher consumer prices as tariff costs pass to end users

- Reduced international competitiveness as input costs increase

- Innovation slowdowns from decreased competitive pressure

- Capital misallocation toward protected but inefficient industries

- Supply chain complexity managing exemptions and rules of origin requirements

Long-term competitiveness depends on whether protected industries use breathing room to improve productivity and innovation or simply enjoy protected markets without fundamental improvements. Historical evidence suggests mixed results, with some industries successfully developing under protection while others become permanently dependent on government support.

Technology Sector: Fragmentation and Duplication

The technology industry faces profound transformation as the integrated global ecosystem fragments into competing blocs. Semiconductor supply chains span multiple countries with specialized capabilities—design in the United States, manufacturing in Taiwan and South Korea, assembly in China and Southeast Asia. Tariffs and export controls force expensive reconfiguration as nations build domestic capabilities across the entire value chain.

This fragmentation creates both opportunities and costs. Companies positioned in protected markets enjoy captive demand and reduced competition. Consulting firms, construction companies, and equipment suppliers benefit from massive investments building duplicative manufacturing capacity globally. However, overall industry efficiency declines substantially as economies of scale diminish, R&D spending disperses, and standards fragment creating compatibility challenges.

Agriculture: Retaliatory Target

Agricultural products frequently become pawns in trade disputes as affected nations retaliate against tariffs by targeting politically sensitive farming sectors. American soybeans, pork, and wheat face restricted access to Chinese markets. European agricultural products encounter barriers in various markets. These restrictions devastate farming communities dependent on export markets, with government subsidies often required to maintain farm viability.

The agricultural sector’s vulnerability stems from its political importance and limited ability to relocate production. Unlike manufacturing that can move to tariff-free zones, farms remain geographically fixed. Perishability and transportation costs limit market alternatives when major export destinations become inaccessible. This makes agriculture an effective retaliatory target but also creates humanitarian concerns when trade disputes threaten global food security.

Economic Class Implications

Working Class: Jobs vs. Purchasing Power

The working-class experiences complex, contradictory tariff impacts creating political tensions within this demographic. Manufacturing job creation in protected industries provides employment opportunities in regions decimated by previous offshoring. Wages in reshored sectors may increase as labor demand rises and foreign competition diminishes. These tangible benefits create political support for protectionist policies among workers benefiting directly.

However, broader working-class populations face significant cost increases as tariffs raise prices for consumer goods, electronics, clothing, and household items. Lower-income households spend proportionally more on goods versus services, making them particularly vulnerable to tariff-induced inflation. The jobs created through protection may not offset purchasing power losses, particularly for workers in non-protected sectors experiencing higher costs without corresponding wage increases.

Middle Class: Squeezed from Multiple Directions

Middle-class households face pressure from multiple tariff-related dynamics. As consumers, they experience higher prices across numerous product categories reducing real income and living standards. As professionals, they may work in export-oriented industries suffering from retaliatory tariffs or service sectors dependent on trade-related activity. Investment portfolios experience volatility as market uncertainty and reduced global growth impact returns.

Some middle-class segments benefit from tariff policies. Professionals in protected industries, domestic supply chain management, trade compliance, and government contracting enjoy increased opportunities. However, aggregate middle-class prosperity likely declines as efficiency losses, higher costs, and reduced economic growth outweigh benefits to select winners from protectionist policies.

Wealthy and Corporations: Adaptation Strategies

Wealthy individuals and large corporations possess resources enabling adaptation to tariff environments more effectively than average citizens. Multinational corporations restructure supply chains, establish production in multiple regions avoiding tariffs, and lobby for industry-specific exemptions. Financial resources enable investments in automation offsetting higher labor costs from reshoring. Access to sophisticated tax planning and regulatory expertise minimizes negative impacts.

However, even wealthy populations face headwinds from tariff policies. Reduced global economic growth constrains investment returns across asset classes. Geopolitical tensions increase market volatility and reduce predictability essential for long-term planning. Capital controls and financial fragmentation accompanying trade barriers complicate international investment and wealth preservation strategies.

Macroeconomic Consequences

Global Growth Deceleration

The International Monetary Fund and World Bank project meaningful global growth deceleration through 2026 attributable substantially to tariff escalation and trade policy uncertainty. Reduced trade volumes decrease economic efficiency as comparative advantage exploitation diminishes. Business investment declines amid uncertainty about future trade policies, regulatory frameworks, and market access. Supply chain reconfiguration diverts capital toward redundant capacity rather than productivity-enhancing innovation.

Growth impacts distribute unevenly with export-dependent economies experiencing sharper slowdowns than large domestic-market nations. Emerging markets relying on manufacturing exports to developed nations face particular challenges as developed countries reshore production. Commodity exporters suffer from reduced global demand as industrial production slows. These dynamics increase global inequality both between and within nations.

Inflation Pressures and Monetary Policy Complications

Tariffs create direct inflation through higher import prices and indirect inflation as domestic producers raise prices facing reduced competition. This tariff-induced inflation complicates monetary policy as central banks must balance controlling price increases against supporting growth during trade-disrupted economic slowdowns. Traditional tools prove less effective when inflation stems from supply-side barriers rather than demand excess.

The inflationary environment particularly challenges lower and middle-income households spending proportionally more on tradeable goods subject to tariff increases. Real wage growth stagnates or declines even during nominal wage increases if inflation outpaces income growth. This erosion of purchasing power reduces consumption demand, creating stagflationary dynamics with slowing growth alongside persistent inflation.

Strategic Winners in the Tariff Age

Countries Positioned Between Blocs

- Vietnam: attracts manufacturing relocating from China while maintaining relationships with multiple economic blocs

- Mexico: benefits from nearshoring trends as American companies seek tariff-free access to U.S. markets

- India: leverages massive domestic market and democratic credentials attracting businesses diversifying from China

- Southeast Asian nations: capture production fleeing higher-cost or geopolitically risky locations

- Eastern European countries: attract European manufacturing seeking lower costs within tariff-free EU market

These nations share characteristics enabling success in fragmented trade environments: strategic geographic positioning, improving business climates, cost competitiveness, and relationships with multiple economic blocs avoiding forced alignment with single spheres.

Industries and Companies Benefiting

Certain sectors thrive in protectionist environments despite aggregate economic costs. Domestic manufacturers in protected industries enjoy higher prices and market share. Consulting firms advising supply chain restructuring experience surging demand. Construction companies building reshored manufacturing capacity secure substantial contracts. Logistics providers managing complex, geographically dispersed supply chains capture increased business.

Legal and compliance professionals specializing in trade regulations, tariff classifications, and exemption processes find expanding opportunities. Automation and robotics companies benefit as reshoring drives demand for labor-replacing technologies offsetting higher wages in developed nations. These winners demonstrate how economic disruption creates opportunities alongside challenges, with benefits flowing to those positioned serving transformed market needs.

Strategic Losers and Vulnerable Sectors

The biggest losers from tariff escalation include consumers facing higher prices with limited ability to substitute toward domestic alternatives, particularly for electronics, clothing, and specialized goods without domestic production capacity. Export-dependent manufacturers in retaliated-against sectors face shrinking markets and excess capacity. Global supply chain coordinators who previously optimized internationally now manage fragmented, less-efficient regional networks.

Small and medium enterprises lack resources for sophisticated tariff navigation, regulatory compliance, and supply chain restructuring that large competitors deploy. Developing nations excluded from preferential trade relationships find market access increasingly difficult. Workers in non-protected, trade-exposed industries experience job losses without offsetting gains from reshored employment in different sectors requiring different skills.

Conclusion

The world economy in 2026 reflects fundamental restructuring as the age of tariffs reshapes trade patterns, industrial location, and economic relationships globally. Winners include certain protected industries, strategically positioned nations, and sectors serving fragmented supply chains. Losers encompass consumers facing higher prices, export-dependent businesses cut off from markets, and economies lacking adaptation resources or strategic positioning.

The aggregate economic impact likely proves negative as efficiency losses, reduced competition, and misallocated capital outweigh benefits to protected sectors. However, political dynamics favor protectionism despite economic costs, suggesting tariff policies persist regardless of efficiency arguments. Successfully navigating this environment requires understanding which industries, countries, and economic classes benefit from fragmentation while recognizing broader prosperity depends ultimately on cooperation and trade rather than barriers and conflict. The challenge ahead involves balancing legitimate national interests with recognition that excessive fragmentation impoverishes everyone through reduced growth, innovation, and prosperity that global commerce previously delivered.